Do a quick search for “credit union marketing strategies”, “credit union marketing plan” – or even “how to market a credit union”. You’ll find a lot of the same, thin recommendations over and over again.

Most articles focus on guerrilla marketing, direct mail, in-person relationship management, and other suggestions that are not even really strategies.

What’s not covered in depth is online marketing strategies for credit unions.

And that makes sense…

The financial industry is notorious for being slow to change. This is often thanks to old-school board members, compliance teams, and budget guardians who want proof of exactly what results they can expect before they're willing to try anything new. In fact, if you’re reading this then you’re probably already ahead of the curve. Nice work!

But, you came here for actionable strategies you can use for your credit union marketing plan, right? Before we get to those, let’s look at what exactly a “marketing strategy” means for the purpose of this conversation:

Credit Union Marketing Strategies

|

Many of the current resources get the terms "strategy" and "tactics" confused and are really providing aimless tactics without a strategy to guide them. Deploying tactics without first developing strategies will lead to unpredictable and inconsistent results. Here, we share several marketing strategies and ideas for tactics to implement within each focus. Since our expertise is in digital marketing, these are all digital strategies. You’ll want to integrate these into your overall credit union marketing plan based on its goals. Note: This may seem obvious, but it’s important to differentiate your marketing strategies from the tactics used to carry them out. |

Credit Union Marketing PlanA good credit union marketing strategy brings all of the institution's marketing goals into one comprehensive marketing plan. This comprehensive plan should focus on the right mix of strategies and tactics to achieve profit, sustain business, and help meet the credit union's overall business goals. |

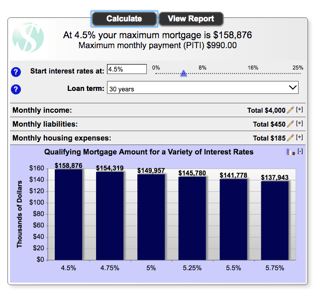

If you need help deciding how much to allocate to your digital marketing strategy, use this free calculator tool for an instant estimate of what your marketing budget should be based on a few factors.

In this article, we discuss four excellent credit union marketing strategies and how to take action with each one. For more credit union marketing inspiration and practical advice, visit our Credit Union Marketing Resources page.

Table of Contents

- Content Marketing for Credit Unions

- SEO for Credit Unions

- Digital Advertising for Credit Unions

- Marketing Automation for Credit Unions

1. Content Marketing for Credit Unions

When it comes to online marketing today, it’s imperative you have a strong content marketing strategy.

When it comes to online marketing today, it’s imperative you have a strong content marketing strategy.

Whether you budget for new content once a month or once every few days, having a plan behind the content you publish is critical for good organic rankings and a positive user experience.

Most credit unions will have 5-10 main products to produce content around with several other secondary products and services.

Because the banking industry is so competitive, it’s important to have a comprehensive collection of resources to offer people – from those who don’t know your brand to your lifelong members.

The good news is you probably have a head start on these resources. Tools like loan calculators and easy-access pages like “rates” pages are just a couple of examples of resources that visitors often search for and depend on during their buyer’s journey.

But the different types of content you end up creating, tweaking, and perhaps even removing, will depend on what exactly you want to accomplish with your content marketing efforts. This is where the overall content marketing strategy can take your efforts in many different directions.

How to Take Action With Content Marketing

Improve user experience: One of the best reasons to implement a content strategy is to ensure that your site’s content is high-quality in terms of usability and helpfulness. The ultimate goal of a content marketing strategy is to answer the questions your target audiences have as it relates to your products and services.

Avoid publishing content that is low-quality and does not boost the authority or credibility of your website. In fact, continually producing content that does not read well, does not help the reader solve a problem in some way, or has other low-quality characteristics will decrease your ability to have a positive impact on users – which correlates with conversions.

One easy way to take action is to take inventory of your site’s current content – ideally with a program like Screaming Frog – to check for low word count pages. In the past, a few hundred words were sufficient for creating a successful blog post. However, in today’s competitive digital landscape, 1,000 words per blog post is the minimum (with exceptions) for your blog to be considered a comprehensive article.

Note: The page minimum of 1,000 words does not include service pages (such as an Auto Loans page) although they can be long, too. It all depends on what it takes to deliver your readers the best information.

An easy way to see how long your service page should be is to check the competition. If all high-ranking pages are around 500 words, that's probably where you'll want to land; if they're all 2,000 words then consider a page that's around that length (just make sure the content provides value to the reader!).

Once you've identified your low word count pages (those with less than ~500 words), ask yourself if the page can be added to or combined with another related page. If you find pages that have low word counts with good conversion data, especially landing pages, it’s okay to leave those alone or only make minor tweaks.

Achieve better organic rankings: Since ranking well for search engines is a top priority for most credit unions, consider keywords and user intent when building your content strategy.

Creating content that speaks to what your target audience is searching for (which you can identify with keyword research) is a great way to chip away at those organic positions and start to see improvements in organic traffic and conversions.

A simple and effective way to approach keywords and organic rankings is to choose one of your verticals – such as auto loans or credit cards – and create a plan specific to that vertical. Research and identify the popular keywords that people search to find information on those topics (e.g., best first credit card for young adults) and create content that targets those keywords. You can create blogs that provide the information the searcher is looking for, or you can add content to your relevant product or service pages that users will find valuable.

As you begin to put a content marketing plan together, it’s important to analyze your current performance metrics. Common metrics include organic search position, traffic volume, time-on-page, and engagement rate. These are all available through Google Analytics, except for rankings. You can observe your organic search positions in Google Search Console. The basic idea here is to look at these metrics before you start and document a baseline. You can then develop and implement your content strategy in an effort to improve those figures.

Once you’ve implemented your content plan around that topic, you can review the performance and tweak your next round of content based on what worked and what didn’t work.

Your Content Marketing Strategy

If you want to provide great resources online, convert users when they’re on your site, and rank well for search engines, you’ll need a strong content marketing strategy for your credit union.

It’s important to remember that content marketing is a long-term process. Yes, you can get quick wins here and there, but the real results come over time with committed work over the long haul.

If you’re just getting serious about content marketing, or you feel you need to make some changes, just be sure to document where your site stands today and make measured changes and additions to your content. After some time, take a look back to see what impact the content has had and keep after it with the new insights.

2. SEO for Credit Unions

SEO, or Search Engine Optimization, is a critical part of marketing. A strong SEO strategy can easily take your credit union from the middle of your competitors to the top.

In fact, that’s literally the goal: move your credit union from the bottom of the search engine rankings to the top of the rankings – ideally on page one of search engine results pages (SERPs).

Because SEO has such a major impact on business today, it has become a large category with different focuses, many different applications, and many more opinions on how it should be done.

There are a couple of specific “types” of SEO that are really impactful for credit unions; the two types we recommend you focus on are local SEO and technical SEO. Here’s a quick look at each one:

Local SEO Strategy

According to Moz, the goal of local SEO is to increase search visibility for businesses that serve their communities face-to-face. These can be brick-and-mortar businesses with physical locations, like credit unions, or service-area businesses that operate throughout a certain geographic area.

Local SEO includes everything from claiming a business listing to ensuring a franchise location appears in a local search on Google. It may also include managing online ratings and reviews, social media engagement, and more.

Why Is Local SEO Marketing Important for Credit Unions?

Having a sound local SEO strategy is critical for credit unions because you are competing in specific geographic locations. “Claiming” these local areas can make it both easier and harder to show up on SERPs.

It’s easier because it’s beneficial to have a specific area to link your credit union to. That makes it easier for search engines to determine that you are an appropriate result to show searchers in the areas you’re claiming.

The reason it’s harder is that most credit unions investing in marketing – particularly those that are working with a marketing agency – will be investing a good portion of money into local SEO, making it highly competitive.

Whether your locations are filled with competitors who are already doing local SEO or yours is the first to try, make sure your credit union is taking the foundational steps to show up in local search results.

Take Action With Local SEO

Get started with Google Business Profile: If you haven’t done so already, it’s critical that you get your credit union set up on Google Business Profile. If you’re unfamiliar with how to operate Google Business Profile, it’s worth asking a professional to assist you.

Schema Markup: Using and optimizing schema markup on your website is another excellent way to impact your ability to show up in local search results. Google, Microsoft, Yahoo, and Yandex actually collaborated to create a resource with schema protocol that would work for most major search engines online.

You can visit the resource site, schema.org, which provides everything from educational blog posts to templated schema code that you can apply to your own website (after customizing for your credit union).

Link-building and directory listings: Establishing a good foundation of links pointing to your website is really helpful for SEO. It can be great for local SEO in particular if you build links that are relevant to your credit union locations and service areas.

A great way to find local directories is to do a competitive analysis of the links that your competitors have and review them for any directory links. When you spot a directory that you’re not currently listed in, it’s often as simple as submitting your information. Many directories are free but some will require a fee.

Note: It’s very important to make sure the listings to which you are submitting are not spammy because adding spamming links to your site may have a negative impact.

You can also implement link-building strategies that do not include listings. These approaches often include guest-posting on blogs, working with reporters and online publications for relevant content, and more.

PRO TIP: Use services like Help A Reporter Out (HARO) to get access to reporters who are actually seeking out sources. It's a great way to acquire hyper-relevant links from authoritative publishers (sometimes as notable as The New York Times, Wall Street Journal, TIME, and more). Just be sure you request a link to your site when working with the reporters because they're not required to add a link but should oblige if asked.

Where the listings approach can be quick and very location-specific, the non-directory approach tends to take more time and it will be tougher to get links that are both relevant to the financial industry and your location.

Technical SEO Strategy

“Technical SEO" is a broad focus within SEO. The reason there’s a lack of clarity is that SEO is already technical, so technically the line between “standard” SEO and the more technical approaches can be debated.

Econsultancy provides a nice analogy to explain what technical SEO is: Think of SEO as a train. You can have the best carriages (the content) you want, but if the engine (technical SEO) doesn't work properly, nobody will ride the train.

Technical SEO often includes knowledge of coding, a deep understanding of how search engines find and rank websites, what impacts page load speeds, and more.

Why Is Technical SEO Important for Credit Union Marketing?

As the analogy above implies, the rest of your SEO and website-based marketing efforts will always be limited if the technical elements are not sound. In addition to ensuring your engine is “running”, there are also many ways to optimize – or tune up – your technical SEO so it performs optimally.

Still not sure why technical SEO makes a difference? Here’s why: Google, and other search engines, put an increasing emphasis on user experience. The better experience you provide for a user, the more likely Google is to show your website.

That means the time it takes a website to load for a user is really important, for example. A difference of five seconds may not seem like much to you, but that’s a significant difference to Google (and users). Remember, you’re competing against many other credit unions who are likely providing similar content, so the more advantages you have over them the better your chances of showing up for searchers.

How To Take Action With Technical SEO

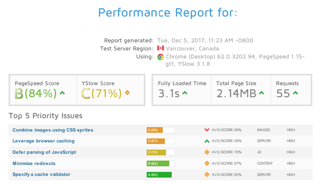

Site speed: The speed of your website is a critical factor for user experience. Luckily, there’s an easy way to get guidance for improving your site’s page speed.

At gtmetrix.com, you can simply plug in your site’s URL and the site will run a speed test on your website in just a few minutes.

With the site speed test, you get a PageSpeed Score and a YSlow Score, and you’ll see the speed and load data of your site. It also lists the top issues with your site that you should resolve to improve its speed.

Meta tag optimization: Each page on your website should have a set of meta tags that help search engine crawlers interpret what your pages are about and what is most important on the pages. Meta tags can also help drive traffic to your website by appearing more relevant or appealing than the other search results (the title tag and meta description will show up in the results).

This type of technical SEO is well-known in the digital marketing and SEO world and marketers that provide SEO should have a complete understanding of how these work and how to implement them. The overall goal of optimizing meta tags is to:

- Accurately explain what the purpose of your page is (and how it’s unique)

- Include relevant keywords to increase the likelihood of showing up in relevant search results

- Organize your content in a way that is logical and easy for users to navigate (creating a positive user experience)

Moz has a great resource for meta tags that you should read whether you are familiar with meta tags or you have no idea what they are. They update this resource every year, so you're likely to learn something new.

Your Credit Union SEO Strategy

Even though local SEO and technical SEO could be split up into two disciplines with enough work for most credit unions, you’ll probably be lumping these together as one overall SEO strategy. Assuming that’s the case, you’ll want to prioritize the most important and potentially impactful tactics first.

The best way to figure out what should get priority is to do an audit on your site. You can run the page speed audit, shared above, to check your website’s speed. If you have access to tools like Screaming Frog, you can crawl your site to identify technical SEO issues – such as meta tag errors.

Once you have a good overall picture of your website’s standing in each area, you can assess which places will provide the most opportunity.

3. Digital Advertising for Credit Unions

Before diving into the digital advertising tactics we outline below, take a second to watch this quick video for a preview of the most effective digital advertising tactics for credit unions.

But, what makes a truly effective advertising strategy?

Subscribe to Credit Union Webinar updates

To create an effective digital advertising strategy, the first step is to define your specific goals. When it comes to credit union advertising, there are typically two main objectives:

- Introduce and sell products to potential (new) customers

- Present and sell additional products to existing customers

Of course, these won't be the focus for all credit unions, but these are the two main objectives that we see most often. With that in mind, listed below are actionable tactics that support these two primary objectives.

Credit Union Advertising For Prospective Customers

The main thing to keep in mind when advertising to new customers is that people will usually fall into one of two buckets:

- They're familiar with your brand (they drive by your branch every day, their sister banks with you, etc.)

- They know nothing about you

When targeting people familiar with you, there's an advantage. Brand recognition is incredibly valuable, which is why businesses pay for branding, so having established familiarity will bring you closer to a relationship with those potential members. If a potential member knows someone who banks with you, that's even better – it's like having a free testimonial.

The rest of your potential members know nothing about you. Think about it: There are a million other financial institutions out there and most look pretty similar at a glance. That statement tends to be even more true for credit unions, especially when terms like "financial credit union" or "federal credit union" account for half of the brand name.

So, while you know that your credit union is special, potential customers have no idea. Reaching your objectives with them typically takes a little more effort and the sales cycle is longer. Remember that they are not familiar with your credit union, so it's important to clearly communicate the advantages of banking with you.

Knowing who you're talking to is half the battle and that puts you ahead of many of your competitors. Keep that in mind as we walk through the following digital advertising tactics for new credit union members.

Social Media Advertising

The 2022 CMO Survey by Gartner shows that financial institutions expect to spend 28.7% of digital budgets on social, search, and display advertising. When you advertise with social media, you get exposure at a time when people tend to be more open to new things.

In addition to the audience's heightened receptiveness, the tools for audience targeting are becoming incredibly robust, making it easier to focus on people who may be interested in your products and easier to filter out those who you know won't be a good fit.

(Google) Search & Display Advertising

Leveraging search and display advertising tools – like Google Adwords – is not a new strategy as part of a credit union marketing plan, but it's still an effective one.

That's because running ads in the search engine results pages (SERPs) and on targeted websites is a great way to get returns on your advertising dollars.

Here are a few reasons why:

- Targeting: Google is known for its targeting capabilities. With these ad campaigns, you can target specific keywords, locations, times, and so on. These capabilities are far more advanced than those of traditional media.

- Traffic: It's easy to predict and monitor the exposure of your advertising. Google provides estimated traffic volumes to help you establish the best degree of targeting before you run your ads.

- Budgeting: Google also makes it easy to adjust budgeting for your ads. Whether you're having success and want to increase your spending or you want Google to manage the spending for you, there are plenty of settings to help you configure your ad budget accordingly.

- Testing: One of the best ways to get the most from your search and display ads is to test multiple versions of every ad you run. Constantly testing multiple versions of your ads will allow you to slowly improve your conversion rates over time, leading to optimal ROI for your ads. Google makes this easy.

Remarketing

Remarketing campaigns are a powerful way to advertise to visitors on your financial product pages, perhaps those who are shopping for the best rates as they shop for loans or savings products. Remarketing allows you to advertise to people who are actively searching for and interested in specific products or services. Continue to remain fresh in their minds with Google and social media ads related to the pages they visit. HubSpot provides helpful information on remarketing and retargeting ads or you can contact WebStrategies for assistance with digital remarketing or retargeting campaigns.

Credit Union Advertising For Existing Customers

Now that we’ve covered advertising tactics for prospective customers, let’s discuss promoting additional products to existing members.

For the sake of brevity, we'll start by saying that you can leverage social media advertising, search & display advertising, and remarketing for existing customers just like you can for potential customers.

However, the advertising we want to highlight here takes place on different real estate – your own real estate, in fact...

What we’re referring to is your website.

If you're like most financial institutions, you get a lot of traffic to your site every day, mostly from customers logging in to their accounts. While you want to ensure that you're providing a great experience for your customers, you can also take this opportunity to introduce other products that they don't know about.

Banner Image Ads

Since most of the visitors to your site are there to accomplish a specific task (typically to log in to their account), you'll only have a few seconds to get their attention with ads for other products.

That's what makes banner image ads so powerful. You know the saying, "A picture is worth a thousand words" – well, it's true that you can communicate much more quickly with visual stimuli to help build your brand.

Since most credit union’s homepages are built with a space for a banner image, it's easy to implement these large, hard-to-miss advertisements.

But adding a banner image to your site is not the advice we’re giving here because most are already doing it. Our advice is to put even more emphasis on these ads.

Most credit unions will put their most recent promotion there, or maybe include a few different promotions in a rotating banner image, and leave it.

But there should be more attention given to the performance of these advertisements. Here are a few ways to get more from your banner image ads:

- Test images. You should always be testing different image variations. Try the same image but with two different background colors or the same promotion but one with a person in the image and another with a family. There are an endless number of variations you can test over time to identify what works best.

- Test calls-to-action, buttons, and other element locations. Just like you should test the images you use, you should also test the different elements that make up the complete image ad, like your CTAs and buttons.

- Keep your image ads fresh. While you want your website to feel familiar and comfortable for users to navigate, you don't want your image ads to be too familiar. The more people see the same image ads, the easier it will be to ignore them. So keep your site updated with current promotions and new ads.

How Much Should You Spend on Advertising?

We've developed a budget calculator specifically for credit unions, offering guidelines for ad spend as well as for other segments of your marketing budget. Download your copy to calculate your budget in seconds.

Our article, How Much Should Credit Unions Budget for Marketing? also offers guidance on how to allocate your credit union's marketing budget.

In many of these cases, you can leverage your existing resources to keep spending to a minimum. In other cases, you'll find that spending a little more can go a long way.

Whichever route you decide on, remember to keep your campaigns fresh and continuously test your ads.

4. Marketing Automation for Credit Unions

Marketing automation has become an essential tool for credit unions to improve the member experience, operate more efficiently, convert more prospects, and grow their share of wallets. As credit unions attempt to remain competitive with large banks and FinTechs, consumers expect the customization, personalization, and quick access to information that automation can provide.

While many credit unions have dipped their toes into marketing automation with tools made specifically for the financial industry that were limiting and clunky, we've seen a huge shift in credit unions embracing more robust platforms that allow them to truly realize the full scope of what marketing automation can do.

How To Take Action With Marketing Automation

Figuring out where to start with automation can be difficult, but we have a host of resources about how credit unions can take advantage of the power of marketing automation. HubSpot delivers the most robust and integrative marketing automation for credit unions that we have seen, but there are other tools and strategies if HubSpot isn't feasible.

- How Credit Union Can Leverage Marketing Automation

- Most Popular Marketing Automation Tactics For Credit Unions

- The Best Marketing Automation System for Credit Unions

- Webinar: Marketing Automation for Credit Unions

- HubSpot for Credit Unions

Leveraging HubSpot for Marketing Automation

Utilizing a tool like HubSpot allows credit unions to seamlessly interact with their members and prospective customers like never before. Gone are the days of manually communicating with your customers online - HubSpot allows you to fully automate communication channels such as emails and chats with members or prospective customers who are navigating your website. However, the communication capabilities of HubSpot only scratch the surface. Relationship management, data tracking and analysis, and countless other automation features make HubSpot a one-stop shop for having more streamlined control over your marketing initiatives.

Using credit union member data to directly reach the next generation is a rich opportunity to build membership. Tools like HubSpot enable marketers to target families with 16-year-olds, for example, with ads for auto loans and student loans. WebStrategies is a Diamond HubSpot Partner and has helped credit unions across the United States to onboard HubSpot and leverage its marketing automation capabilities. We can help your credit union marketing team too. Or, if you use another CRM, WebStrategies has deep knowledge and experience with a wide range of tools to provide innovative integrated solutions to extract rich member data for your targeted advertising campaigns and full-funnel tracking.

Developing a Credit Union Digital Marketing Strategy

Every credit union is a little different – with different budgets, competitors, and unique business and marketing goals. For that reason, there’s no one-size-fits-all marketing strategy that will work for every credit union, every time.

At WebStrategies, we’ve worked with over 60 credit unions in the last 20 years and developed successful strategies for our clients. Every client is still unique, and our approaches change constantly, but we pull from our experiences and tailored processes to create and implement marketing strategies that are effective for any credit union, big or small.

If you're not ready to commit to a marketing firm then you can try the strategies and tactics listed above to find some success in one area or another.

To learn more about how we craft custom credit union marketing plans, contact us today at 804-200-4545 or visit our Credit Union Marketing Resources page.

Note: This post was originally published on May 28, 2021, with updates on July 13, 2022, June 9, 2023, and October 9, 2023.

Agree, disagree, or just have something to add?

Leave a comment below.