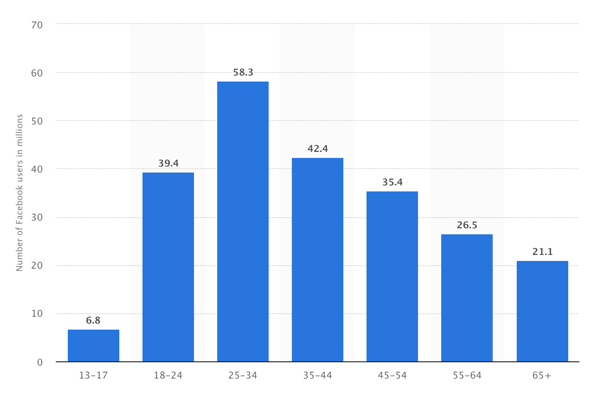

As social media platforms grow in usership, they have become a crucial part of inbound marketing. As of April 2018, Facebook has reported over 2 billion monthly active users in the world. In the United States alone, over 200 million people have a Facebook account. Almost 70% of Americans say that they use Facebook on their desktop or phone.

Many of the credit unions we talk to are unsure of whether social media is important for driving loan and membership growth. Some common objections we get are:

- Social media is meant to be social. Nobody is going to apply for a loan from an ad.

- When I post something, I get very few ‘likes’. Why would we spend money when we can’t get any engagement.

- Social media is used by millennials who don’t have a large SOW.

While all of these are legitimate concerns, all of them can be debunked if social media is used correctly. For example, when it comes to millennials, what many fail to realize is that the millennial population is getting older and increasing their financial power. Pew Research Center defines Millennials as born from 1981 to 1996, meaning they are 22-37 years old right now. This is a huge opportunity to connect with users who are looking to grow their savings, buy houses, and take out a loan.

Is Organic Social Media Still Important for Credit Unions?

One of the main questions we get is how often credit unions should be posting on social media. All social media platforms handle organic posts very differently, but we focus mostly on Facebook and Instagram due to their historical performance for our clients. Organic reach on Facebook has declined significantly over the last 5 years. Why? Facebook has prioritized advertising over organic content.

While many companies and users speculate that Facebook did this to increase profits, usage of the Facebook app hasn’t decreased. What has decreased is the percentage of users who see an organic post from a company page. Studies have shown that as little as 5% of your fans will see a post. Because of this decline, paid social media advertising has become even more critical.

First Determine Your Credit Union Marketing Budget

Before you jump head first into budgeting for social media, you should do some industry research on marketing budgets for credit unions. To help with this, we’ve compiled data from the top 100 credit unions and calculated the average marketing budget expressed as an amount spent per member.

Learn more about How Much Credit Unions Should Budget For Marketing. We’ve even created a marketing budget calculator to help you determine how much you should be spending based on industry benchmarks.

Calculating Your Credit Union Social Media Budget

Once you’ve determined your total marketing budget, consider your most effective marketing channels. If you don’t have data showing which sources drive the most loan and membership applications, strongly consider investing in tracking your digital marketing efforts.

After deciding your digital marketing budget, it’s time to break that down to the platforms you should run on. For most credit unions, the first priority should be search advertising. Social media advertising is a close second. We recommend that credit unions spend about 20-30% of their digital advertising budget on social media marketing.

Other questions to take into consideration when determining your budget:

- What is your digital marketing goal? Increasing loan growth and member growth may require different tactics and targeting.

- What is the membership application experience like? Many credit unions are late adopters of online account opening and the experience is clunky. If your goal is new members, consider how important online account opening is to driving membership growth.

Other Resources: How to Set a Realistic Social Advertising Budget

Tracking Your Social Media Advertising

One of the best things you can do with digital advertising is setting up conversion tracking. Running advertising without tracking how many people opened an account or applied for a loan isn’t recommended and setting up conversion tracking is easier than you think.

Installing a Facebook Pixel on your website can also help you learn more about the demographics and interests of the people actively visiting your website, and it can help you create target audiences for advertising campaigns. Effectively tracking your social media advertising hinges on your loan vendor’s ability to install Google Tag Manager which is the only way to track membership and loan applications from digital advertising campaigns.

Running Credit Union Social Media Advertising

Revisit your digital marketing goals and how you would like to utilize social media to accomplish those goals. Below are just a few recommendations.

- Targeting current members - This is typically our first consideration for Facebook. Since the platform is covered with ads, we see better performance from ads shown to current members who may take advantage of additional products.

- Finding users who look like your current members Facebook has an interesting feature called lookalike audiences, which targets people with similarities to your existing database.

- Targeting users who are in-market for a product - Facebook’s 3rd party Audiences will be going away soon, so you may need to be more creative with your targeting methods.

- Use bold messaging - Try different copy like “The New Way To Save Hundreds” for high interest checking account or “Don’t Throw Away Money, Get 2% Cash Back On Purchases” for a high rate credit card.

- Utilize Social Media for your best products - Promoting an average CD rate may not be the best way to utilize Facebook. Consider your target audience, their financial position, and what products they would be most interested in. The more you can segment your audiences, the more relevant your message will be to each user.

We’ve compiled a list of Social Media Examples for Credit Unions to help you with creative and messaging. Make sure you A/B test your creative and look for opportunities to continuously improve your results.

Get Started!

To grow your loan portfolio and membership, reaching your current members and potential members on social media is becoming more and more crucial for credit unions, and while investing in social media advertising instead of relying on organic posting has become critical, the results from a well-structured and targeted campaign more than justify the expense.

Have more questions about credit union social media spending or other digital marketing topics? Visit our Credit Union Marketing page, or contact us.

Sources:

https://www.statista.com/statistics/408971/number-of-us-facebook-users/

https://www.statista.com/statistics/187041/us-user-age-distribution-on-facebook/

https://www.statista.com/statistics/398136/us-facebook-user-age-groups/

https://blog.hubspot.com/marketing/facebook-organic-reach-declining

Agree, disagree, or just have something to add?

Leave a comment below.