The credit union industry is unique compared to most B2C industries. Credit union data is collected and stored across multiple different platforms like their website, perhaps a CRM, their core and LOS. This can make it more complicated for credit union marketers to accurately track their marketing ROI compared to other industries that only rely on a CRM to maintain their data.

To get an accurate ROI measurement from each marketing channel, your goal should be to track a customer’s journey from the moment they begin an application to when they hit submit, and beyond.

However, depending on what LOS software you use, this can be a big challenge.

Throughout this article, we’ll look at the marketing results tracking capabilities of several different LOS platforms for credit unions.

What types of tracking exist?

Tracking can be minimal or robust depending on the LOS that your credit union uses. Some LOS providers support full tracking in which you can see submitted applications broken down by marketing campaign. This provides a much more holistic view of how your credit union’s marketing efforts are performing. Tracking on this level requires installing Google Tag Manager (GTM) on loan/account applications.

Other LOS providers may be able to install custom Google Analytics code on applications which allows you to see submitted applications. Still others may not be willing to install GTM or Google Analytics code making tracking submitted applications impossible.

Which loan origination software supports full tracking?

If you can advance your tracking and successfully monitor the number of funded loans that each channel is generating for your credit union, you are much better equipped to determine what’s working and where to shift your budget.

Here are some of the LOS platforms that support full tracking:

With the exception of CU Direct and MeridianLink, you can implement tracking on all of these LOS platforms using Google Tag Manager.

For CU Direct, you will have to install custom Google Analytics code, whereas MeridianLink will require some other unique workarounds.

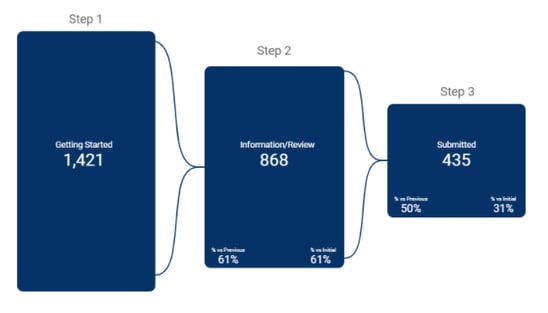

Once tracking is properly set up, you can create custom conversions in Google Analytics for when a user starts an application, clicks to review more information, and hits submit in your LOS.

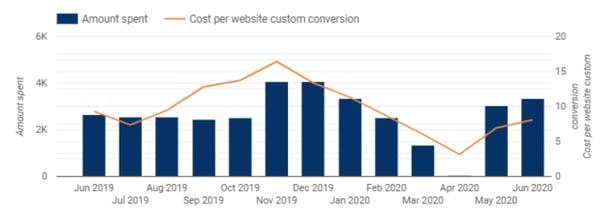

This information allows you to easily monitor your average cost per application start and submission for each of the processed products in your LOS.

But the tracking doesn’t stop there.

You can also monitor the ROI of your advertising campaigns, analyze the performance of your application funnel, and much more.

Loan origination software that supports limited tracking

There are a few loan origination software platforms that we have come across that allow you to install Google Tag Manager or basic Google Analytics code, but tracking drops off after an application submission. These platforms include Lending 360, Loanliner, and CU Solutions.

![]() Although these platforms don’t offer the level of tracking as some others, they still provide credit unions the opportunity to determine their average application completion rate and apply it to their advertising campaigns.

Although these platforms don’t offer the level of tracking as some others, they still provide credit unions the opportunity to determine their average application completion rate and apply it to their advertising campaigns.

Loan origination software with no tracking capabilities

Unfortunately, many LOS platforms for credit unions are still unable or unwilling to integrate with Google Tag Manager or Google Analytics, making tracking very limited. Some of these platforms include:

- Member First

- Homeowners Advantage

- FiServe

- NetIt

- myCUmortgage

- CU Members

- Akcelerant

- Mortgage Click

- Decision Assist

If your credit union utilizes one of these platforms, we suggest that you work with your LOS to determine whether they will allow installation of Google Tag Manager or custom Google Analytics code. However, if you’re unsuccessful, you can still leverage “step-zero” forms to capture leads on your website before they click over to your LOS.

Implement tracking on your LOS

When considering a transition to a new loan origination software, there are several factors that you should consider based on the day-to-day operations of your credit union. However, having the ability to track as much information as possible is something that you should keep top of mind.

Understanding how your application funnel is performing and which channels generate the most revenue for your credit union are essential to making the most of your marketing budget.

If you would like to learn more about different loan origination software platforms and their capabilities, or how to start tracking between your website and LOS, click the button below to connect with us!

Agree, disagree, or just have something to add?

Leave a comment below.