In this post, we’ll cover why we at WebStrategies like MortgageBot from a tracking perspective.

This is only one limited perspective so if you are choosing a mortgage application system for your financial institution, you'll have other factors to consider.

Let’s jump right to it…

Benefits of MortgageBot for Application Tracking

The reason we like MortgageBot is that we can deploy Google Tag Manager (GTM) within the application.

One of the biggest advantages of being able to install GTM, on any application is the ability to set up cross-domain tracking. This gives us the ability to understand what traffic sources are driving the most conversions. And that becomes particularly important when you want to assess the value of your marketing efforts.

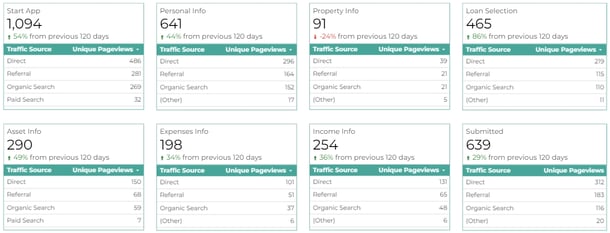

In the image below you can see the steps that an applicant went through within the application as well as the original traffic source that brought them to the site.

Here is what that looks like when it is built out in Datastudio, one of our favorite reporting tools:

Application Tracking Yields Analysis

You might see this funnel and think…

- Where are all of these referrals coming from?

- Why are only 58% of applications that start an application finishing it?

- Are there any unique characteristics of the applicants that finish the application?

- What pages did those who submitted applications view before they submitted?

- How many times did those who submitted an application come to the website before they decided to apply?

These are just a few of the questions that can help us improve our marketing efforts by understanding the segment(s) of users that decide to apply.

It all starts with having the right tracking in place

To set up your GTM container on MortgageBot is not overly complicated but it will require some previous knowledge of GTM. The one area where we see the most friction is cross-domain tracking.

It’s not always as simple as setting it up and watching the source data get passed along to Google Analytics (GA). When setting this tracking up you have to consider gaps that may skew your tracking.

For example, can members apply through your online banking portal? If the answer is yes, then do you have GTM set up on that portal as well?

In most cases, the answer to the last question is "no", in which case it becomes important to understand how those applicants that do apply through the online banking portal are categorized in GA.

Once tracking is in place and working correctly, then you can create goals or build funnel reports like the one pictured above.

Other Popular Mortage Application Systems

While MortgageBot is a great application system and we are particularly fond of its ability to accommodate GTM tracking, there are several other application systems that offer similar capabilities.

Over the years we’ve seen several companies rise to become powerhouses in the mortgage lending industry. Two in particular that we’ve seen are Encompass and Blend.

Credit Union Application Tracking

Each system has its unique capabilities, features, and caveats. What works for one organization might have to be adjusted slightly for another.

While tracking is an important consideration it’s also important to assess how that system aligns with your organization's long-term strategy.

We’d love to hear from you!

- What struggles are you currently facing with your mortgage application system?

- What issues have you run into when trying to set up reporting for a LOS or POS?

- Is there anything you would add to this article that you think is missing?

Let us know your thoughts in the comments section below.

Contact Us

Note: LOS providers can change their rules and regulations regarding installing GTM code on applications. At the time of publishing, MortgageBot allows the installation of GTM code for tracking.

Agree, disagree, or just have something to add?

Leave a comment below.