For many different reasons, people start applications online and don’t finish the process. This is especially true with more people starting applications on mobile devices. Form abandonment is a hurdle that all credit unions (and all businesses, really) face. But there’s actually a way to curb this common application “leak” and to learn who is starting applications. First, we have to address the heart of the issue.

Why are people starting applications but not finishing them?

You may never exactly know the reason why some of your website visitors aren’t finishing an application because several factors could influence that decision. Today, people are more stimulated by technology and other outside influences than ever before—so it’s likely that a potential applicant could have just gotten distracted.

Another common reason that many people don’t complete applications is that they lack the appropriate information needed. Often, a potential applicant may abandon a form to retrieve more information and forget to return at a later time.

Finally, the user experience of your application process may play into why users do not finish an application. Long or poorly designed forms can cause people to abandon applications, so your application process must be concise and easy for potential applicants to complete.

The point is, just because the person abandons the form, it doesn’t mean they’re no longer interested, and it also does not have to mean you’ve lost them forever.

How to capture abandoned application data

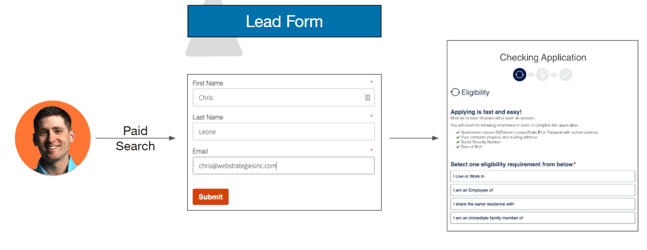

The issue of identifying people who have abandoned applications can be easily solved by embedding a “step zero” form onto your credit union’s website. Using free marketing software such as HubSpot, you can include a simple form with a small number of contact fields along with your CTA to apply for a loan.

While it may seem tedious to ask for information before a user visits the full application, this process is critical for collecting details that will help you re-engage with visitors who abandoned an application, and we have not found it to be a deterrent in moving forward with an application.

Once the user has submitted the “step zero” form before entering your LOS software, their contact information will be sent directly into your CRM so that you can follow up with them. You'll also be able to tie them back to funded loans, improving your results tracking.

How to communicate with leads collected

The contact information that “step zero” forms will provide you with can be much more valuable than just for identification purposes. By having the visitor’s contact information, permission to market to them, and the product(s) that they’re interested in, you can follow-up accordingly.

There are several different options that you can use for following-up, including primarily:

- Phone calls

- Automated text messaging

- Automated email

You can decide to use one or a combination of these outreach options to re-engage your potential customers, depending on what you believe is the best fit for your credit union.

An easy way to get started

Using marketing automation to nurture leads throughout the application process is a great way to get started in gaining value from the information that you have collected through “step zero” forms.

HubSpot is an excellent option for this process. With their robust marketing automation software, you can set up individual workflows for each of your loan products. Contacts can be automatically entered into these workflows once they complete the form tied to that application on your website.

This is the easiest way for you to get started in nurturing visitors who have abandoned applications because once the setup process is complete, there is no more work to be done. Marketing automation will handle all of the work for you so that you can focus your time on other tactics to generate new applications.

Track marketing results with step-zero forms

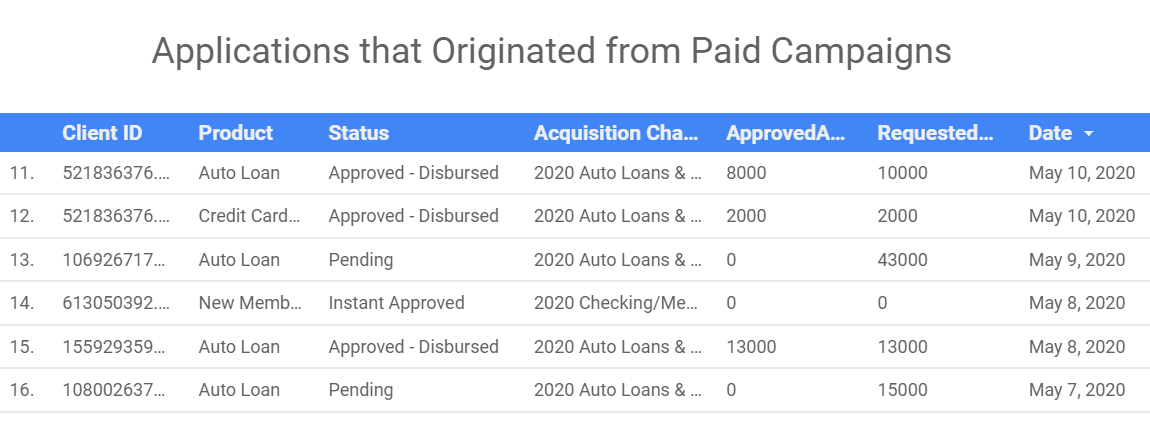

“Step-zero” forms are also an essential piece in helping credit unions implement end-to-end tracking of their funded loans, especially if using an LOS system that is not compatible with putting tracking in place.

By including a form from HubSpot or another marketing software before a visitor enters your LOS, you can easily identify where that applicant came from and tie revenue directly back to specific marketing channels.

This can provide tremendous value in helping you identify which marketing or advertising campaigns are performing the best. With the ROI of individual marketing and advertising channels, you can reassess your work and optimize your campaigns to avoid wasting any valuable dollars of your marketing budget.

Use marketing automation to nurture your leads

Including “step zero” forms on your credit union’s website before a visitor gets redirected to a loan application is a very minor change with a drastic impact. Having the ability to identify potential customers who abandon loans, collecting the information necessary to effectively follow up with those leads, and precisely tracking the amount of funded loans that your marketing efforts are generating are just a few of the benefits of this approach.

Furthermore, marketing automation is an excellent way to nurture those who abandon your applications to encourage them to return and complete it.

Would you like to learn more about marketing automation for credit unions? Here are 7 Reasons Credit Unions Are Adopting Marketing Automation that you may find helpful.

Agree, disagree, or just have something to add?

Leave a comment below.