Originally published September 2016. Updated Jan 2019 with lifetime value example.

When you spend $1 on marketing, how much should you expect in return?

That's what we'll answer in this post.

/////

When someone asks you, “is your marketing working,” what do you think they’re really asking? Are they asking if it’s generating awareness, generating foot traffic, or generating sales?

When I ask this question, I want to know if your marketing is effectively generating business in a profitable way. That’s really what marketing spend is trying to accomplish, after all.

Anyone responsible for spending money to generate revenue (e.g. marketers) should have a simple way to know if their activity is generating business. This is why return-on-investment (ROI) is such an important metric for any business activity.

What Are The Challenges Of ROI?

ROI is calculated using two primary metrics: the cost to do something, and the outcomes generated as a result (typically measured in profit, but for this discussion, let’s use revenue).

The standard answer to "how to calculate ROI" is a formula:

(Attributable Sales Growth - Marketing Cost) / Marketing Cost = ROI

There are a few challenges with calculating return on marketing investments this way.

For one, calculating ROI for marketing can be tricky, depending on how you measure impact and costs. Figuring out what portion of sales growth is attributable to a marketing campaign can be difficult. Large corporations have complex ROI formulas and algorithms which factor dozens of different variables.

Secondly, measuring marketing ROI manually for each marketing campaign takes time and access to company financials.

Thirdly, this approach requires patience. It could be months before knowing if a campaign was profitable.

In a nutshell, calculating marketing ROI the “traditional” way isn’t always practical. We need a better method.

So let’s shelve the complex formulas, attribution models and algorithms and focus on one simple metric: the revenue to marketing cost ratio.

What Is The Revenue To Cost Ratio?

The revenue to marketing cost ratio represents how much money is generated for every dollar spent in marketing. For example, five dollars in sales for every one dollar spent in marketing yields a 5:1 ratio of revenue to cost.

What Is A Good Marketing ROI?

A good marketing ROI is 5:1.

A 5:1 ratio is in the middle of the bell curve. A ratio over 5:1 is considered strong for most businesses, and a 10:1 ratio is exceptional. Achieving a ratio higher than 10:1 ratio is possible, but it shouldn’t be the expectation.

Your target ratio is largely dependent on your cost structure and will vary depending on your industry.

Why Use A Ratio?

Ratios are easy to understand and easy to apply. Before any marketing program or activity is started, everyone understands what it needs to generate to be successful.

Also, as long as the right tracking mechanisms are in place, everyone can quickly determine if a campaign was successful or not.

What Is Counted As A Marketing Cost?

When calculating your ratio, a marketing cost is any incremental cost incurred to execute that campaign (i.e. the variable costs). This includes:

- pay-per-click spend

- display ad clicks

- media spend

- content production costs

- outside marketing and advertising agency fees

Because full-time marketing personnel costs are fixed, they are NOT factored into this ratio.

The ratio is meant to give campaigns a simple “pass/fail” test, so the costs factored into the ratio should only occur if the campaign runs.

Why Is 5:1 A Good Ratio?

At an absolute minimum, you must cover the cost of making the product and the cost to market it.

A 2:1 revenue to marketing cost ratio wouldn’t be profitable for many businesses, as the cost to produce or acquire the item being sold (also known as cost-of-goods-sold, or COGS) is about 50% of the sale price. For these businesses, if you spend $100 in marketing to generate $200 in sales, and it costs $100 just to acquire the product being sold, you are breaking even. If all you accomplish with your marketing is break even, you might as well not do it.

Companies with higher gross margins (their COGS are LESS than 50% of the sales price) don’t need to achieve as many sales from their marketing before they become profitable. Therefore, their ratio is lower.

Meanwhile, companies with lower margins (their COGS is MORE than 50% of the sales price) need to stretch their marketing dollars further before it becomes worth doing. Their ratio would have to be higher.

Resource: Cross selling online can help increase customer lifetime value, which lowers your cost-per-acquisition goal.

Why Lifetime Value Is Critical When Calculating ROI

Lifetime value refers to the value a customer brings a business over their entire life as a customer, NOT just through their first transaction with you. Many businesses only think in terms of first transaction value and call it a day. But the customer life can be far more fruitful than that, so to accurately calculate return on investment, we need to understand the full return.

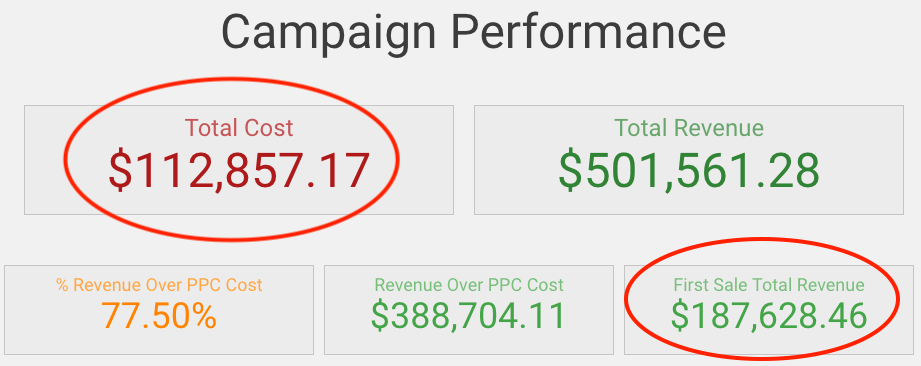

For example, we worked with one client to set up a tracking a reporting system for the paid search campaign (PPC). Previously, we would only attribute the first sale generated from a PPC click back to the campaign. In reality, these customers would come back several times, usually from other channels, to make additional purchases. Since that customer came from the PPC campaign, PPC should continue to get credit for incremental sales made.

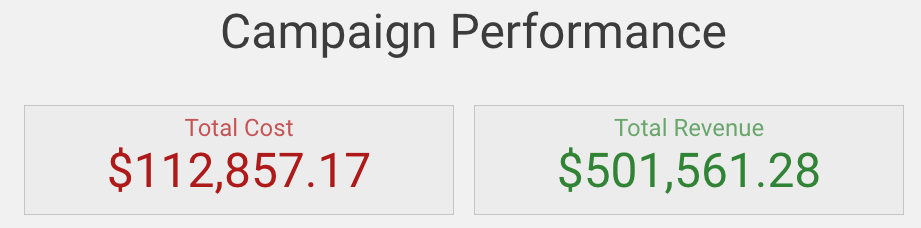

Remember that chart at the beginning of this post showing $500k in revenue on $112k spend? This client had achieved the 5:1 revenue to spend ratio, but that's not the whole story. Prior to adding repeat purchases to this chart, the return on PPC looked a lot different. And it wasn't pretty.

When we only counted first sale revenue from PPC and not lifetime value, we weren't even achieving a 2:1 ratio.

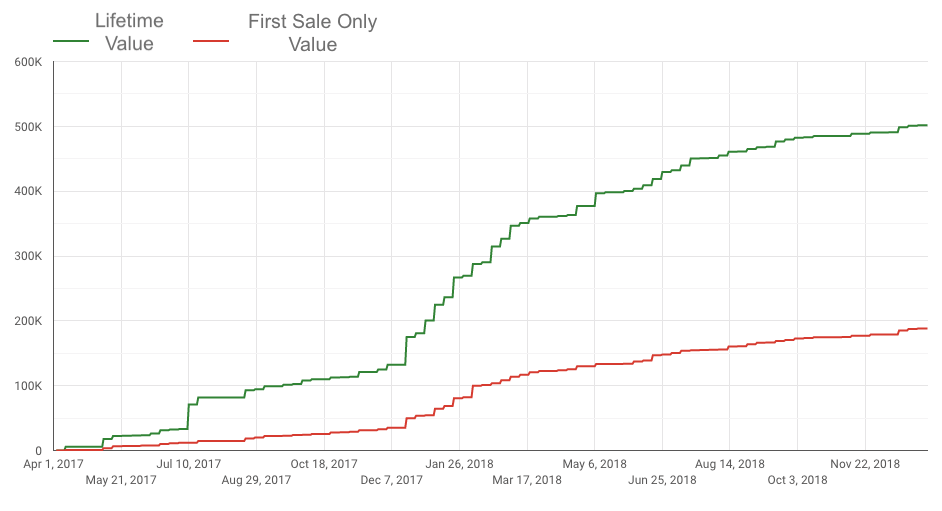

And here's how the cumulative difference between first sale value and lifetime value looks over time.

The spend never changed, but our perception of the campaign's impact on revenue (and ultimately ROI) changed dramatically.

How Do I Calculate My Target Marketing ROI Ratio?

A CMO, CFO, or CEO will be able to calculate your target ratio. They will factor in the company’s gross margin targets, overhead expenses, and what it takes for money to hit the bottom line (the ultimate goal).

Keep in mind that achieving a 10:1 ratio every time is unrealistic, and shouldn’t be the expectation for your marketing campaigns. For most businesses, a 5:1 ratio will be the target, and anything beyond that is gravy.

Final Thoughts On Calculating Marketing ROI

It is not easy to calculate revenue generated for all marketing activity. Certain tactics like social media, content marketing, video, and display ads for a targeted audience starts long before a purchase takes place.

Marketing software platforms such as Hubspot, Marketo, and Pardot do a good job of connecting early engagement to a final sale, but they are not perfect.

Just because a marketing activity can’t be measured perfectly, it doesn’t mean it shouldn’t be considered.

That being said, marketers should always work to connect the dots between activity and revenue. Advances in web analytics software and methodology provide better insight for measuring activity over time and across different devices.

Finally, marketing is about generating revenue. It’s not about art, humor, or creativity.

Marketers who aren’t serious about tying their activity back to revenue are missing the bigger picture.

Implementing a ratio, and treating it as the “golden metric” for marketing activity, will focus the team on the ultimate outcome: growing the business.

TL;DR

Every $1 spent on marketing campaigns should yield approximately $5 in revenue. This will vary depending on the economics and COGS of your particular business.

You may also be interested in:

How Much Should You Budget for Marketing in 2018?

Agree, disagree, or just have something to add?

Leave a comment below.