-2.png?width=730&height=426&name=Blog%20Post%20Feature%20Images%20(4)-2.png)

Should you still have a Social Media ad budget?

Have AI bots taken over, or do real people still regularly engage across Meta ad inventory?

Is Meta still a trusted digital advertising platform for credit unions?

We strongly recommend factoring social media into your marketing plan, but stay informed and vigilant, keeping up with frequent shifts and updates.

As of April 2025, according to Meta’s Q1 reports:

- Meta’s apps reached 3.43 billion daily active users in March 2025 - up 6% YoY

- Ad revenue reached $41 billion, up 20% YoY

The audience is there - how should credit unions most effectively reach them? Let’s rewind back to the world pre-Covid, before the Metaverse and AI explosion to understand the full context of where we started, where we’re going, and what we can do now.

Social media advertising for credit unions has changed quite a bit over the past few years. Finding and converting your target audience on Facebook or Instagram used to be easy. Advertisers could access demographic details, interests, and behaviours that users shared. Facebook's partnerships with third-party data providers helped connect people with the right message in more ways.

Of course, it was too good to be true. In the face of growing privacy concerns, Meta ended its relationships with third-party data providers and introduced the Credit Special Ad Category policy. This had a nearly immediate impact on financial institutions' advertising on the platform.

Intended to prevent discrimination, the policy stipulated that any advertiser promoting products related to credit, housing, or employment opportunities must clearly label their ads as such, which severely limited targeting opportunities for credit unions.

In January 2025, Meta replaced this “Credit” category with “Financial Products and Services,” which is even more comprehensive. In addition to specific restrictions for products like credit cards and personal loans, all financial products, including checking and savings accounts, are now highly regulated. Credit unions do not have the capability to reach audiences by age, gender, or zip code. Plus, there is a requirement to add a fifteen-mile radius around targeted cities or addresses, and all advertisers are now forced to comply with the location targeting setting of the ambiguous “people living in” OR “recently in this location”. So there’s no guarantee ads are strictly reaching your Field Of Membership.

In addition, the impact of Apple’s iOS 14 changes also affected who advertisers can reach on mobile devices. All apps within the Apple App Store are required utilize AppTrackingTransparency (ATT), which requests users’ consent to track their data and actions across apps and websites.

In other words, Apple now requires all apps in their App Store to allow users to opt out of tracking and data collection. This limits our ability to target people based on their interests and behaviors while using mobile device apps.

Meta has also taken away the ability for financial institutions to create lookalike audiences from their own members list to find similar people and removed the capability of audience expansion.

So, what does this mean for credit unions that still want to utilize social media advertising? This article outlines three excellent tactics for improving your credit union’s social media advertising strategy.

Tactics for Improving Your Credit Union’s Social Media Advertising

- Utilize Interest-Based Targeting Attributes

- Leverage First-Party Data for Targeting

- Consider Diversifying on Other Platforms for Social Media Advertising

- Bonus: Be AI-Cautious

1. Utilize Interest-based Targeting Attributes

Meta has some limits for advertisers in the Special Ad Category. Still, advertisers can target users interested in specific financial products. This includes options like “home equity loan,” “credit cards,” and “savings account.”

We also suggest being creative with interests like "Trulia" and "Zillow." This helps you reach people shopping for houses. You can use "vacation rental" to attract those looking to fund a trip with a personal loan or a new credit card.

We have also found success with non-linear targeting. This means choosing interests based on the similar behaviour or traits of your ideal audience.

It goes beyond using Meta’s data for more obvious options. You can target users based on their interests. For example, you might focus on those looking for a “moving company” to advertise mortgages.

Or, you could reach out to people interested in an “automobile repair shop” to show ads for refinancing car loans. Targeting a "charitable organization" can help you reach people with disposable income. They are likely interested in products like IRAs or high-minimum certificate accounts.

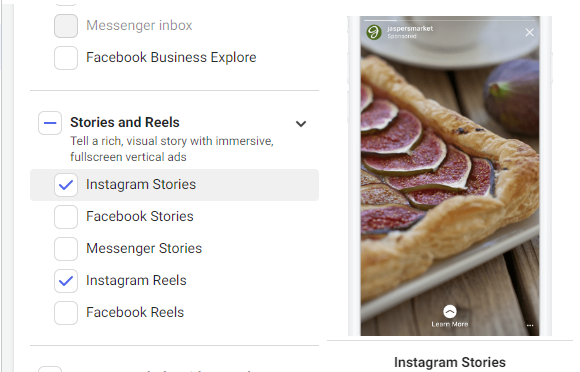

You can leverage placement targeting and creative design that will speak to your target audience. The example shown below highlights the ability to choose specific placements for your ads to ensure you meet your target audience at the right time.

For example, an ad run exclusively in Instagram Stories and Reels featuring fun, animated creative and using images/videos of Gen Z-aged folks will be much more compelling for a younger demographic.

The inverse is also true; when we ran a credit card campaign promoting a travel rewards offer, excluding Instagram led to 75% reach in 25 to 54-year-olds, our target audience for this campaign.

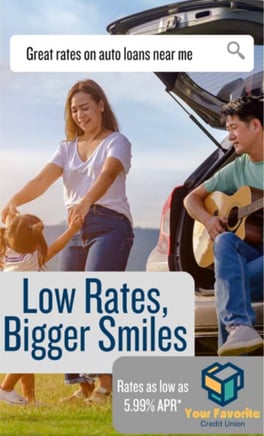

The creative below illustrates how to leverage creative design that will speak to your target audience - this creative was used for a Facebook Ad campaign targeting growing families seeking a great auto loan rate for a newer, larger vehicle.

2. Leverage First-party Data for Targeting

Facebook allows advertisers to upload their own lists of first-party data (email addresses, phone numbers, etc.) that can be matched with users’ data to find and target the exact people they want to reach. This is ideal for remarketing efforts to your current members, improving your share of wallet, or promoting a limited-time offer. The creative below shows an effective way to promote a limited-time offer on a rewards credit card to your existing members.

In a separate example, our credit union client used their own data to generate a list of people who may be good candidates for a short-term line of credit. Essentially, they took the targeting into their own hands! Using this method, we generated 3 new accounts for just $200.

Leveraging first-party data gives you a significant advantage in understanding your target audience. You can use this information to target a hyper-specific group of people or a more general audience, like what’s shown below.

3. Consider Diversifying on Other Platforms for Social Media Advertising

There are still many platforms that allow the use of demographic and third-party data in targeting, including LinkedIn, TikTok, Snapchat, Pinterest, and many other niche options.

As is the case with every digital advertising tactic, understanding your long-term goals, member lifetime value, and average cost-per-acquisition is vital in determining a comfortable budget for your campaigns. Starting out with a limited budget (even $10 per day!) on Meta may be incredibly successful - just make sure you regularly dive into your data to figure out what’s working and what could be improved.

Test audiences, test creative, test landing pages, test placements - collecting this level of detail will help you make better, data-driven decisions for your social media campaigns.

4. Be AI- Cautious

In recent months, Meta Advantage has begun dominating the Ads UI - creating default settings for automatic “ad enhancements” including adding random music, unapproved resizing and cropping, and more. Advertising experts who require more control over assets and brand safety, and especially those who require compliance (hello, EVERY credit union), will turn off the majority of these AI- driven add-ons. At least for now, ad managers maintain autonomy to monitor and adjust these settings, but that may not always be the case.

As major ad platforms continue competing in the race for the best, fastest, most efficient automation - make sure your ad performance still comes out ahead. Test new features but don’t trust them blindly; create experiments to avoid funneling your full budget into unchartered territory. Rely on your own historical benchmarks and best practices while peppering in controlled A/B testing, but always question and keep an eye on new features and tools - especially before they’ve been vetted by the ad community.

Agree, disagree, or just have something to add?

Leave a comment below.