-1.png?width=730&height=426&name=Blog%20Post%20Feature%20Images%20(3)-1.png)

Every Credit Union aims to attract new members and serve their existing ones better. But what happens when prospective members visit your website and leave without taking any action?

This scenario—passive engagement—is a common challenge for Credit Unions. It results in lost opportunities.

Prefer Video? Click here to watch Caroline explain.

Tools like HubSpot, a marketing platform, can transform passive interactions into engagement. Credit Unions can boost conversions and grow their membership by tracking visitor behavior and automating follow-up. This blog explores methods for using HubSpot to encourage website visitors to take action.

Understanding the issue

Passive website engagement occurs when visitors explore your site but fail to take the next steps, such as submitting a loan application or signing up for membership.

Without insight into visitor behavior, Credit Unions miss opportunities to personalize their outreach and encourage action. HubSpot’s automation capabilities provide a powerful solution.

Solution: Using HubSpot's Marketing Automation

- Website Behavior Tracking

With HubSpot’s tracking capabilities, you can:

- Identify which pages a visitor has viewed and how long they spent on them.

- Spot visitors showing interest but not taking any action, such as clicking on an auto loan page without submitting a form.

- Targeted Email Workflows

HubSpot’s integration with your CRM allows you to:

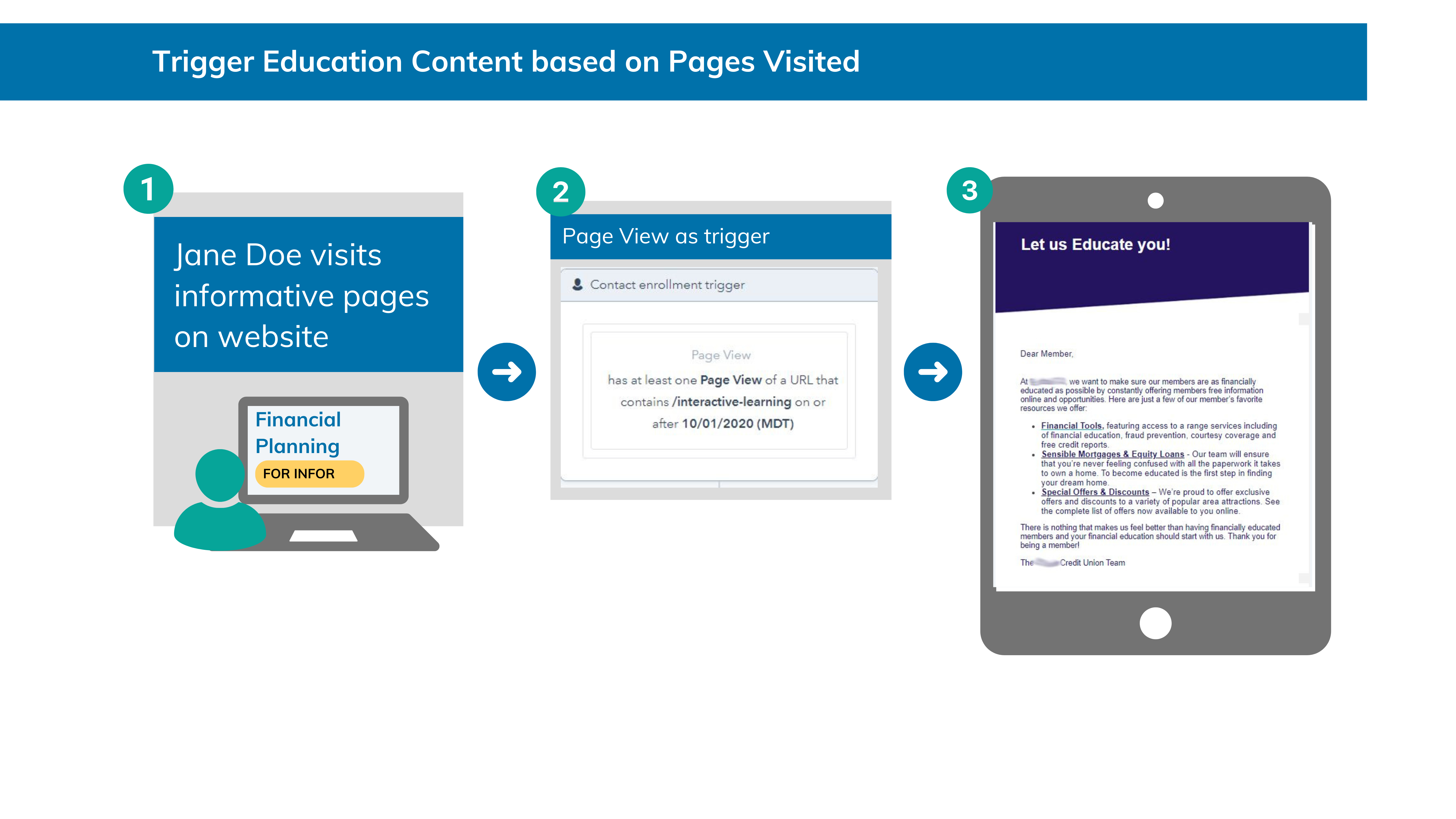

- Trigger personalized emails based on website activity.

- For instance, if someone visits the mortgage loan page but doesn’t apply, you can send them educational content or details about competitive rates.

- Nurturing Prospects

After identifying passive visitors, nurture them with:

- Automated workflows that send relevant, timely information based on their interests.

- Sequences designed to educate prospects about Credit Union offerings, benefits, and application steps.

Example Use Cases

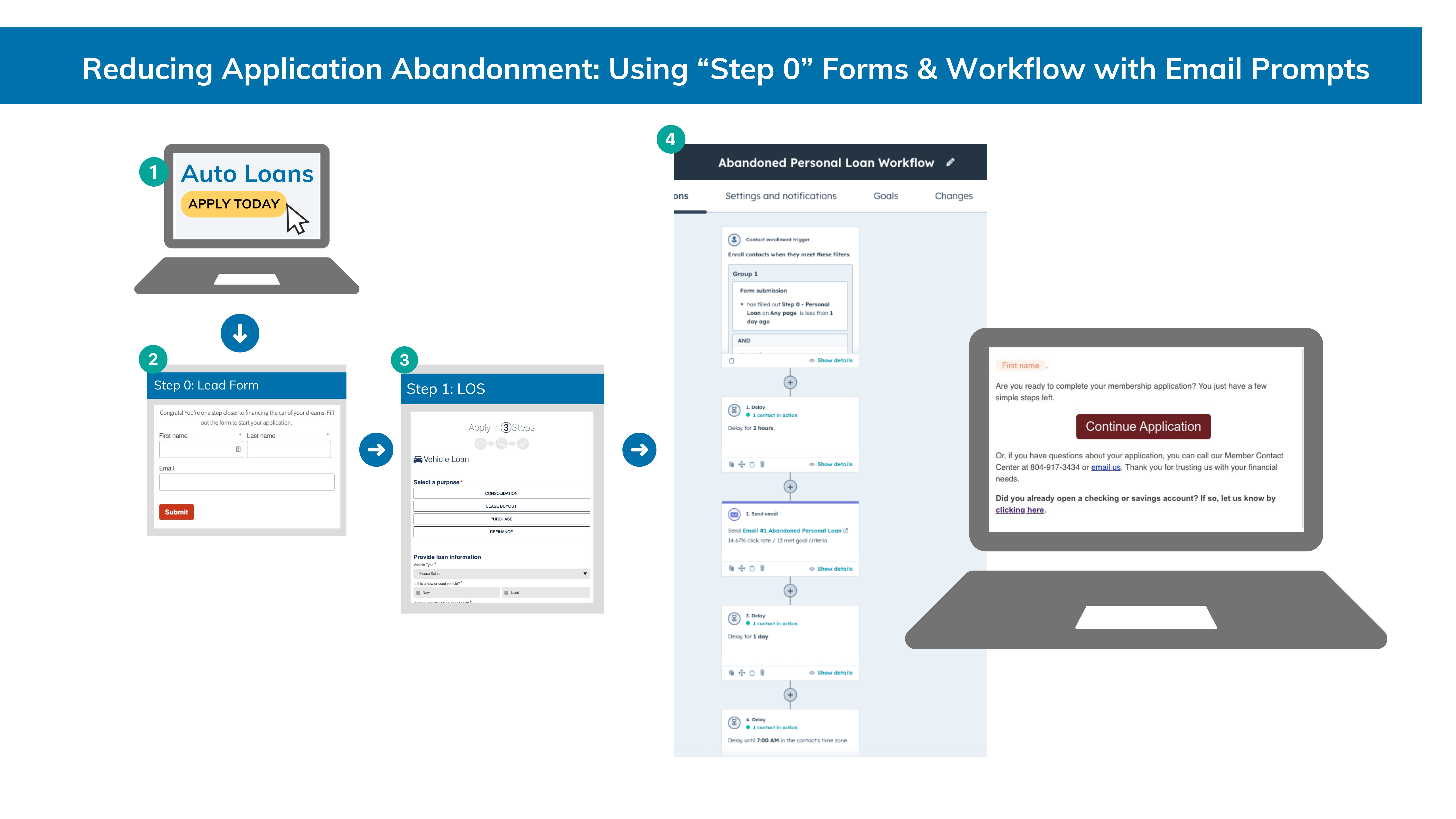

Application Abandonment Recovery

- Implement "Step 0" forms that collect a visitor’s basic information (name, email) before redirecting them to the full loan application.

- Track incomplete applications and enroll contacts in an email series encouraging them to finish. This workflow alone has resulted in recovering up to 35% of abandoned applications for some Credit Unions.

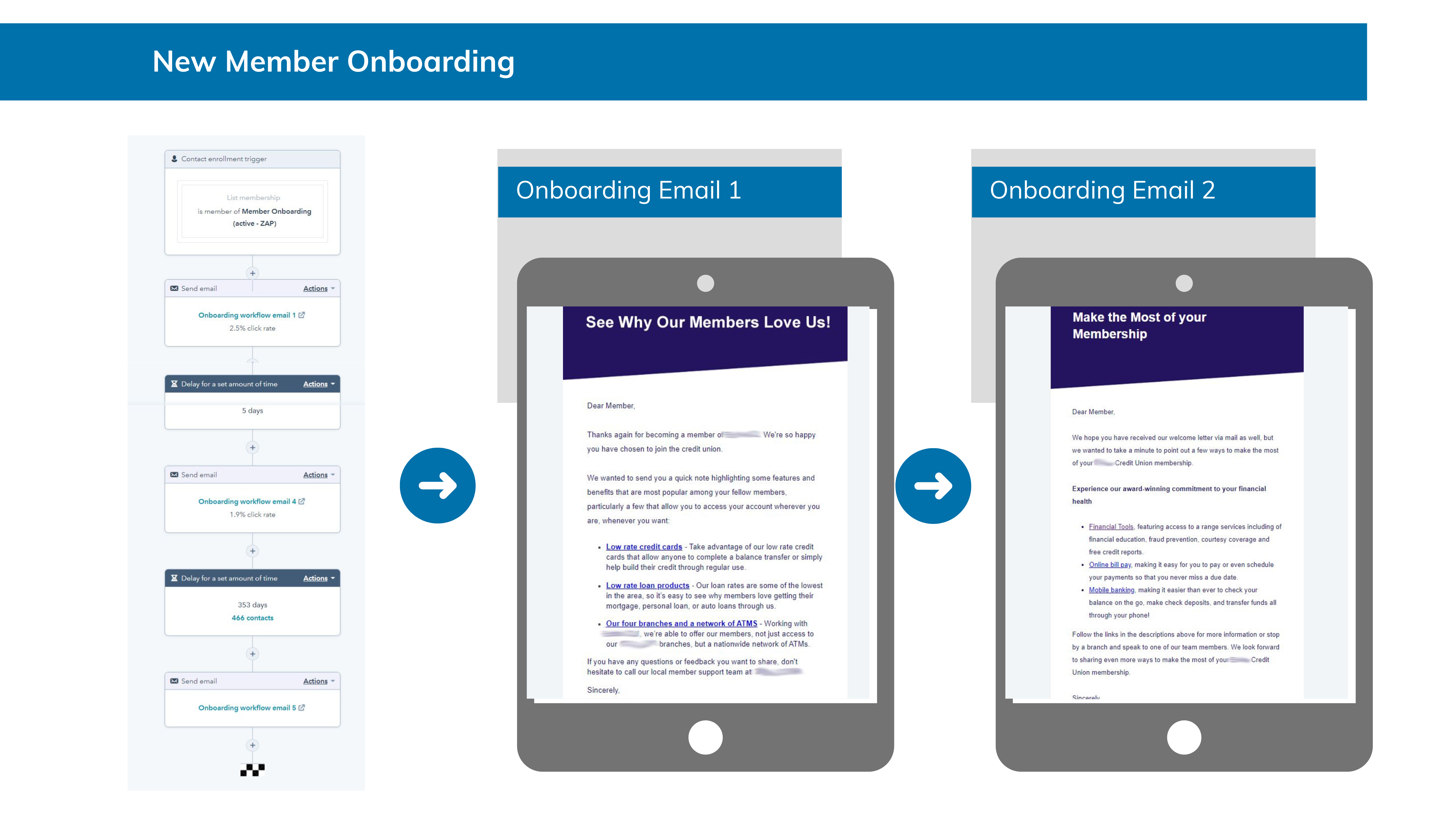

New Member Onboarding

- Use automated email series to onboard new members.

- Provide educational content about Credit Union services like online banking, savings options, and loans.

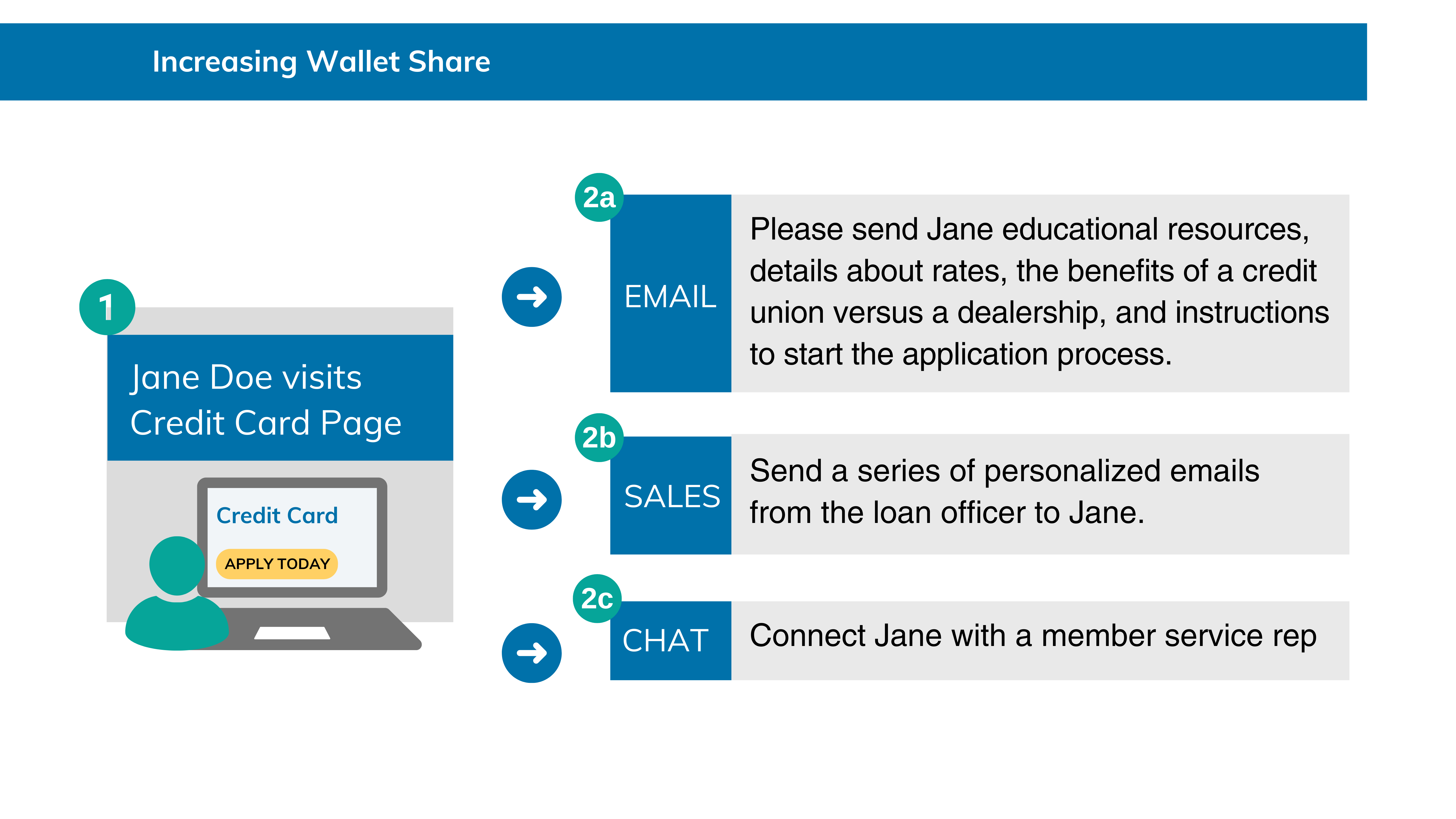

Cross-Selling Opportunities

- Identify members with specific products (e.g., a mortgage loan) and suggest complementary ones (e.g., a home equity line of credit).

- Trigger emails promoting these additional products based on member data.

Why It Works

Personalization: HubSpot's automation tools enable personalized messaging. It uses website behavior and CRM data.

Automation: Marketing automation allows small Credit Union marketing teams to scale their outreach effectively.

Proactive Engagement: Contact prospects and members before they lose interest. This will boost conversion rates.

Key Features for Credit Unions to Leverage

- Retargeting Ads: Use HubSpot’s advertising tools to re-engage visitors who’ve left your site.

- Chatbots: Provide real-time assistance and guide visitors toward relevant actions.

- Detailed Analytics: Gain insights into campaign performance to refine and optimize strategies.

Conclusion

Engaging passive website visitors is a great chance for Credit Unions. It helps them grow memberships and serve their communities better. HubSpot's marketing tools enable targeted, scalable, and personal strategies. They convert interest into action.

If your Credit Union is ready to re-engage visitors and take member acquisition to the next level, consider implementing HubSpot and leveraging these powerful tools. Contact us to learn how we can help you get started.

Agree, disagree, or just have something to add?

Leave a comment below.