Learn What Drives Consumers When Choosing Their Bank or Credit Union.

What would motivate a consumer to change their financial institution?

What do they consider to be most important in a financial service provider?

How do preferences for banks and credit unions vary by age?

(hint: it may not be what you think!)

Get Your Copy Today

We Surveyed Over 1,000 Consumers to

Gain Valuable Insight About:

PREFERENCES

-

What age bracket prefers an online bank versus credit union?

- What factors do consumers value most in their PFI?

-

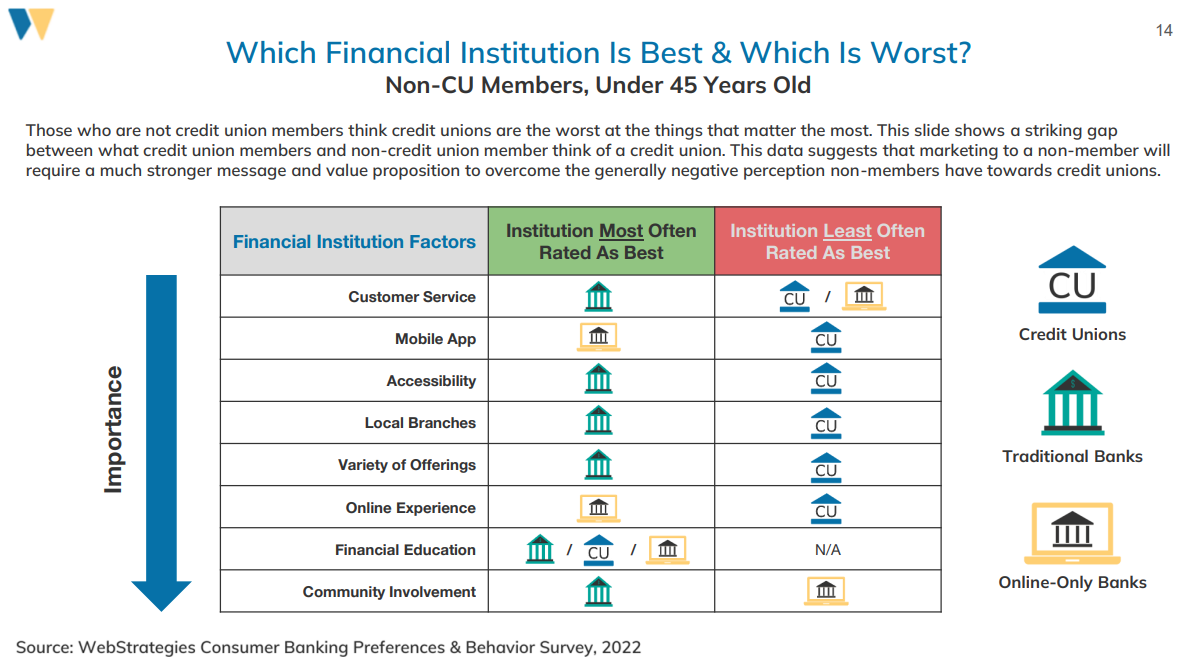

Which do consumers feel are better at customer service - CU or Banks?

- And more +

CONSIDERATIONS

- Which services would consumers switch financial institutions for?

- What service would make consumers consider a mortgage?

- What security concerns are most important to consumers?

- And more +

BEHAVIORS

- Which consumers are are more likely to apply for loans on a mobile app?

- Which consumers are more likely to go to their existing banks for loans?

- What are main differences in consumer behavior over 45 vs under?

- And more +

Nearly two-thirds of those under 45 experience online-only banking in some capacity. These experiences will likely influence their expectations when engaging with a credit union.

Which Institution Has the Best Online Experience?

"This survey inspired conversation with our leadership team about continuously being better at what we do. It helped us look deeper into understanding what we need to be good at for the emerging consumer market. We cannot continue to rest on our laurels of providing great member service, we have to also care about the digital experience, especially with the emergence of online only banks increasing market share."

-1.png)

Robert Einstein

CEO & President | UMe Credit Union

HOW ARE CONSUMERS APPROACHING

NEW OPTIONS LIKE:

Online-Only Fintechs

Cryptocurrency

Don't Miss What's Truly Important to Today's Consumers

A Credit Union with $300 million in assets can spend up to $450K on marketing in one year alone.

The Consumer Banking Preferences & Behavior Report provides detailed responses necessary for making more informed decisions when targeting members and non-members alike.