As a credit union marketer, you may have a hard time keeping up with fast-changing digital marketing trends–especially if you’re juggling many responsibilities. We also often hear frustration with not being able to show a positive ROI and prove the value of digital marketing efforts.

That’s where we come in: Our focus is on digital marketing for credit unions. We’ve implemented successful campaigns for dozens of credit union clients over the past decade.

A big part of proving ROI, is getting proper end-to-end tracking in place. At a minimum, you’ll have Google Analytics installed on your website, and you’ll be tracking conversions.

With tracking set up and a trusted partner to help navigate the latest trends, you’ll be increasing conversions and proving ROI in no time!

Based on our years of experience, here are 3 proven channels that reliably work for financial institutions:

Jump straight to a specific channel:

#1: Paid Search Advertising

Google Search Ads are some of the best real estate on the internet. If you bid on the right keywords, you have a high likelihood of reaching a prospective member with high purchase intent.

To run effective digital advertising for credit unions, you need to make sure the keywords you’re bidding on, your ad copy, and the landing page are all in close alignment with the searcher’s intent and provide a positive customer experience.

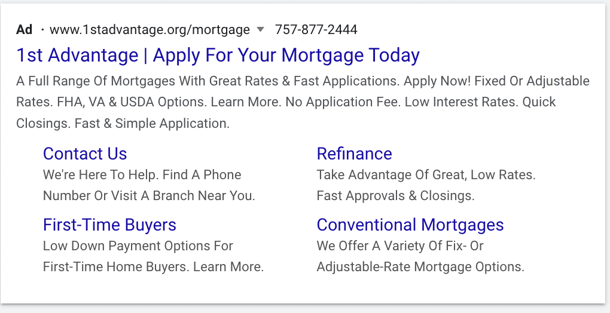

Take a look below at what these live ads look like:

You’ll need to break up your search campaigns into targeted ad groups for the best performance. You can base these ad groups on products or specific keyword groups within a product segment.

For example, you could have a mortgage campaign, but within that campaign are several ad groups for related keywords, such as mortgage rates, mortgage calculator, mortgage fees, [city name] mortgage, etc.

Pro-tip: Get off the old-school marketing calendar and run your targeted search campaigns year-round. This gives the platform an opportunity to self-optimize and improve performance over time. Running monthly or quarterly campaigns is not as effective as running campaigns long-term.

Remarketing ads, or display ads served to specific audiences after they visit your website, can also have an incredible impact for your credit union.

In most cases, you can segment your remarketing ads to show specific ads to audiences you define. For example, show mortgage ads to a visitor who previously visited a mortgage page of your website.

The banner ad to the right is an example of what that might look like on a mobile device.

If you have a remarketing pixel (on Google Ads) or a Facebook Pixel installed on your website, you can create “lookalike” audiences for those ad platforms.

This is particularly helpful when doing product promotion. Part of your promotion plan could include a remarketing campaign to people who visited that product page of your website during the previous 30 or 60 days, for example.

These ads are also a useful marketing tool for credit unions to increase share of wallet. You can set up custom triggers for when someone logs in to submit a loan payment or view their checking account and you can create another valuable audience for your advertising campaigns.

Click here to see how WebStrategies decreased cost-per-click by 55% for a credit union.

#2: Optimizing Local SEO

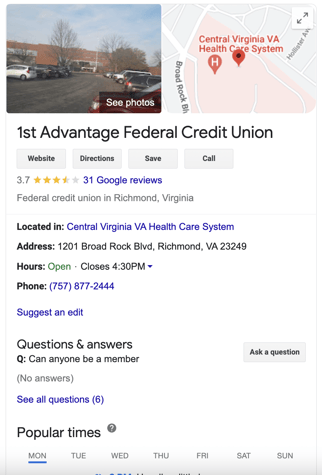

When a prospective customer searches online for credit unions or banks in your area, does your organization show up in the results?

If so, how does your online presence compare to others in the area? Does your credit union show up on map results? Are there positive reviews?

This is not a new digital marketing idea, but local SEO remains a powerful method of attracting new members.

At a minimum, you should have:

- A claimed and optimized Google Business Profile (formerly Google My Business) listing for each location

- Populated your GBP listing with photos

- Reviews on the GBP listing for each location (Don’t fudge this one. Request reviews from real members.)

- A unique page on your website for each location

In addition, strive to make sure that every single listing on the internet with your phone number included matches what’s on your website.

From there, you can start working to increase your perceived reputation or “E-E-A-T” – Expertise, Experience, Authority, and Trust – online.

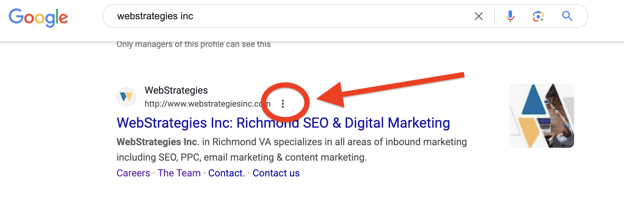

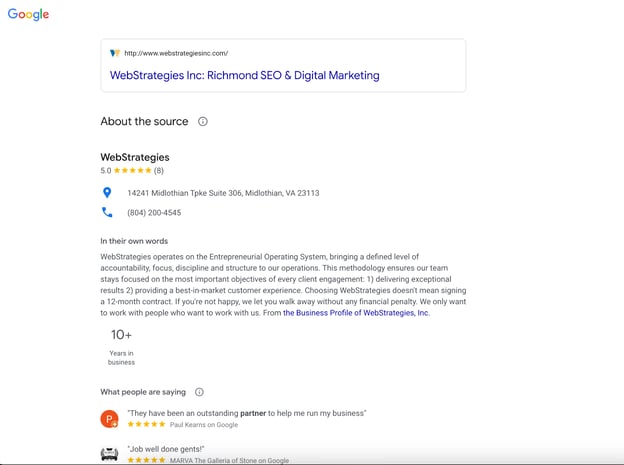

Check now! Here’s a quick way to get a sense of your perceived reputation: Do a Google search for your credit union’s brand name. Beside your site’s URL in the results, click the 3 vertical dots.

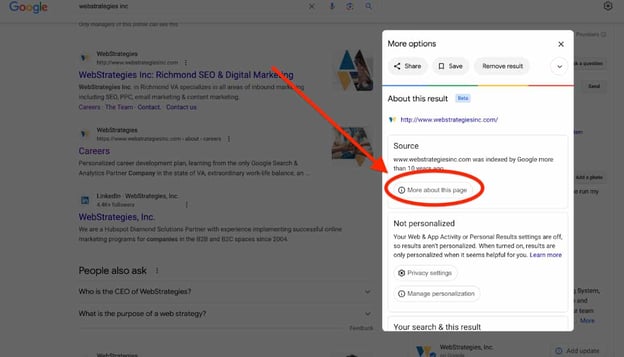

That will load an info box. In that box, click the button that says “More about this page”.

The link will take you to a page of Google’s more prominent sources that it uses to understand your reputation and authority–from customer reviews across different review sites to news and articles published about your credit union.

What shows up here isn’t holistic but it’s a nice little snapshot of how you’re being presented online and how much Google trusts your ability to serve people searching for financial information and support.

Our full SEO process includes keyword research, content marketing, technical SEO, off-page SEO and more.

Want to learn more about our SEO process? Click here to see how we handle local SEO for credit unions.

#3: Hubspot & Marketing Automation

It’s incredibly important to have the right acquisition and on-site engagement strategies in place to get people to your site and help them convert more. But if you’re not including lead nurturing in your digital marketing strategy then you’re leaving a lot of conversions on the table.

As a Hubspot Diamond Partner, we’ve seen first-hand the positive impact of marketing automation and the power of a CRM like Hubspot.

In the dynamic world of digital marketing, credit unions face unique challenges in engaging members, promoting financial products, and proving the ROI of their marketing efforts. That’s where HubSpot and marketing automation become invaluable assets.

Marketing automation streamlines repetitive tasks such as email campaigns, lead nurturing, social media posting, and much more. This efficiency allows credit union marketing teams to focus on strategy and member service, rather than getting bogged down in day-to-day tasks. As a robust CRM, Hubspot can add to the streamlining of your marketing automation.

It also helps improve member targeting and creates more personalized member experiences. The automation tools in HubSpot enable you to segment your audience based on behavior, demographics, and transaction history. This hyper-targeted approach helps keep your audience engaged more frequently and boosts the effectiveness of your marketing efforts.

Finally, marketing automation helps track ROI more reliably and holistically. With Hubspot’s built-in analytics and reporting tools, credit unions can easily track member interactions, campaign performance, and more. These insights are crucial for making informed decisions and continuously improving marketing strategies.

Want to learn more about Hubspot and marketing automation? Explore our library of resources here–including an ROI calculator, case studies, webinar recordings, and several articles.

The Ultimate Goal of Your Digital Strategy

The concepts in this article represent some of the most effective credit union marketing strategies we’ve used to attract new customers and to increase share of wallet online. As years pass by, these tactics continue to evolve and so should your marketing strategy.

Through whatever digital tactics you deploy, your ultimate goal should be to meet the financial needs of members and prospective members.

Paid ads can reach users at their specific time of need. People turn to search engines to answer questions and find solutions. Your ads can reach the right targets at the right time.

Local SEO efforts can ensure your credit union is prominent in search results when prospective members are researching in your area.

Hubspot and marketing automation can offer efficiency, personalization, and increased touchpoints with your members and prospects.

Want to learn more about how we work with Credit Unions like yours? Visit our Credit Union Marketing Resources page.

Note: This post was originally published on November 11, 2021, with updates on December 6, 2023.

Agree, disagree, or just have something to add?

Leave a comment below.