We often hear from clients that the online marketing world is tough to navigate. They rely on us to provide guidance and clarity so they can make the best decisions for their credit union.

We often hear from clients that the online marketing world is tough to navigate. They rely on us to provide guidance and clarity so they can make the best decisions for their credit union.

The constant development of new technology and the rate at which marketing managers need to adopt new technologies can present a unique challenge, especially in more traditional marketing departments.

Below are five challenges we routinely hear from clients and some suggestions on how to deal with them.

1) Social Media Management

Chances are you do not have your social media strategy figured out. Most credit unions are much more likely to have failed on social media than succeeded. This includes organizations of all sizes - from single-branch credit unions to global financial institutions with seemingly unlimited budgets and manpower.

Common Social Media Challenges:

Questions you may already be asking yourself include:What kind of content should we produce?

- How can we produce remarkable content?

- How often should we sell on social?

- Who will do the work?

- How do I hold them accountable?

- Do I have the right person to lead and execute my social strategy?

Work on process:

Deming famously observed that most problems in business can be traced back to process. In our observations working with clients, we’re more likely to see a flawed process for managing social than a flawed content strategy.

Given the choice, you’d rather have a content problem than a process problem. Content and strategy are relatively easy to fix. Incorporating a disciplined process for execution, measurement, and accountability is much more difficult. To overcome the inherent challenges of running a successful social media campaign, start with process, then input strategy.

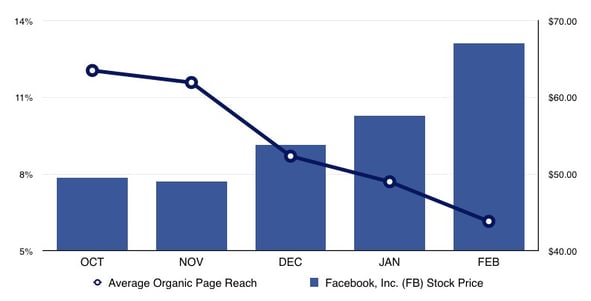

Don't rely on your organic reach:

Organic reach on Facebook is at a historic low. This means businesses must pay to be seen. A credit union, even with a small budget, can have a huge impact on social media by using the paid advertising feature.

Paid advertising through social channels allows you to hit viewers at just the right moment, allowing you to maximize conversions, visibility, and ROI.

2) Multi-Device Usage

As a data-driven agency, one of our biggest challenges is how to track the visitor experience across multiple devices over the course of the consumer buying cycle. We wrote about this a couple months back, but here’s a quick refresher:

Day 1: potential customer is on their couch with their iPhone. They see your product in their Facebook news feed. They click through to your site, take a look, and then move on.

Day 6: that same potential customer is now on their iPad researching products like yours. They can’t remember your brand, but while searching for your type of product, you come up in a Google search result, along with your competitors. They have a look around and compare prices and features, but still don’t apply.

Day 15: potential customer is on their desktop computer ready to sign up. Having seen your website a couple times already, the consumer remembers your web address and goes to it directly. They fill out the application and successfully convert.

How can you possibly trace that sign-up back to its origin (which should be split between Facebook and Google)? According to your analytics, Facebook and Google both sent you a visitor that didn’t convert. If that happens several dozen times, the conversion rate on these channels starts to take a major hit, leading you to question the value of those channels.

But remember, those channels played an integral part in leading up to the purchase.

There are no easy solutions, but being aware of this behavior is the first step to making smarter decisions with the data available, even if it doesn’t tell the whole story.

3) Proving ROI of Credit Union Marketing Activities

Over 50% of businesses consider the ability to measure ROI the biggest challenge facing online marketing.

ROI is a challenge to measure, even in the digital world. We touched on one of the main causes in the second point above: multi-device usage. Browser cookies are a common way to connect website visits back to the marketing channel responsible for generating the visitor.

Unfortunately, cookies do not move across different devices, so the same visitor coming to a website from a smartphone then from a laptop looks like two completely different people. This creates a "break" in the timeline of the visitor, and subsequently a "break" in our ability to attribute marketing investment back to revenue.

Content marketing and social media, two channels that appeal to users in the early stages of the buying funnel, are also difficult to attribute back to sales. The influence of content marketing and social media takes place days, weeks, or even MONTHS before a sale is made.

And once a customer is finally ready to buy, their path is 'direct' (meaning they type the website directly into their browser, or walk right into the store). When this happens, it's not clear how the visitor found us or what influenced their decision to purchase. This results in another "break" in our ability to connect certain marketing activities back to the revenue it generates.

DOWNLOAD OUR EXCLUSIVE BUDGET CALCULATOR FOR CREDIT UNIONS

4) Optimizing The Mobile Experience

For years you’ve been hearing about the mobile revolution. As former Google CEO Eric Schmidt put it, “the trend has been mobile was winning. It’s now won.” We’ve watched client’s mobile traffic go from 5% to 30% in the last couple years. With this shift in traffic comes drops in conversion rates, less time spent on site, and higher bounce rates.

A responsive website, which reformats your site content based on the user’s screen size, is a step towards an improved mobile experience. But if that’s all you do to cater to your mobile audience, you’re missing the boat.

Online banking is a must for Gen X, Gen Y, and Millennial demographic. This can be achieved, to some degree, with a proper mobile website. However, apps have become the standard.

Mobile users have less patience, are seeking different answers, and can be at a different stages in the buying cycle. The mobile user is different and it’s up to you to find out how and why. Only then can you adjust your messaging and presentation to suit the mobile user.

5) Competing With The Noise

As credit unions continue to build out their online banking systems, consumers are provided with more and more choices. The streets have become crowded and everyone wants a piece of the action. Staying on the front end of the curve and rising above the noise is harder than ever. If you are selling the same products at the same rates to the same people, how can you expect to win more wallet share and grow your membership?

Consumer-Centric Approach

From Zappos to Amazon to Apple, the brands that obsess over customer experience win. From product selection to customer service, from product quality down to packaging, each moment was well thought out and brilliantly executed. These little touches add up to an overwhelmingly positive experience, keeping the customer coming back.

Utility Marketing is an emerging consumer-centric strategy, whereby you intersect the consumer at the point of a non-commercial need, become a part of their life, and remain with them until they’re ultimately ready to buy.

Here’s an example:

As someone with wifi enabled devices throughout my house, I like to see the different connection speeds I can achieve from different rooms. This helps me test my wifi strength for devices like an Apple TV or Nest. Similarly, I’d like to know if my cellular connection speed is strong enough to tether my laptop to my iPhone during a client meeting.

To test these speeds, there’s a wonderful app called Speedtest. I open the app, hit Begin Test, and within seconds, I can measure my network speeds. Why doesn’t Verizon, my internet provider, or AT&T, my cell phone provider, offer something so wonderfully simple and useful?

They could offer the same functionality with added features. For example, placing a pin in my location so AT&T can see where my signal is weak. Or Verizon could offer me suggestions on how to improve wifi reach if I register a low wifi signal. There are so many ways these companies could offer me a positive experience, offer me UTILITY, and increase my loyalty with their brand. Instead, they offer clunky apps for checking my account details (which I never use anyway).

If you find yourself scratching your head over some of these issues, you’re not alone. The companies that will continue to innovate, are obsessed over their customer experience, and are willing to invest in and develop process will have an edge in the years to come.

At WebStrategies, Inc, we help credit unions overcome online marketing obstacles. Learn more about online marketing methods such as inbound marketing, Google Analytics, display advertising, and web design and development to start putting together the best plan for your organization.

Agree, disagree, or just have something to add?

Leave a comment below.